Introduction:

Interest Rates on a "Meeting by Meeting" Basis:

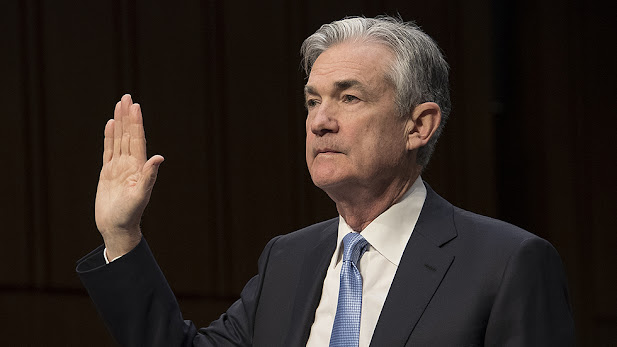

Chair Powell highlighted the Federal Reserve's intention to evaluate interest rates on a "meeting by meeting" basis. This approach indicates a shift towards a more data-driven and adaptive policy stance, allowing the central bank to make informed decisions in response to evolving economic conditions.

Reconsidering the Pace of Interest Rate Increases:

Powell suggested that interest rates may not need to rise as much as previously anticipated due to tightening credit conditions and the challenges faced by the banking sector. The Federal Reserve acknowledges the potential negative effects on economic growth, hiring, and inflation resulting from these developments.

Restrictive Policy Stance:

With the current interest rates ranging between 5% and 5.25%, Powell characterized the policy stance as "restrictive." This term implies that the interest rates are at a level where they neither stimulate nor hinder economic growth, according to the policymakers' perspective.

Job Market Slack and Inflation:

Powell identified job market slack as a significant factor influencing future inflation. This acknowledgment suggests that the Federal Reserve is considering the overall strength of the labor market in its assessment of inflationary pressures.

Inflationary Concerns:

The latest data from the Consumer Price Index (CPI) revealed a headline price increase of 5% and a core price increase of 5.5% over the previous year. These numbers indicate an upward trend in inflation, with a significant portion attributed to the rising cost of shelter. Powell highlighted the persistence of inflation in non-housing services, emphasizing the need for careful monitoring.

Fed's Preferred Measure of Inflation:

The core Personal Consumption Expenditures (PCE) index, the Federal Reserve's preferred gauge of inflation, rose by 4.6% in March compared to the previous year. The upcoming release of the latest PCE data will provide further insights into inflation trends and potential implications for monetary policy.

Future Monetary Policy Decisions:

Powell reiterated that the Federal Reserve's economic forecasts, including interest rate projections, should not be interpreted as a rigid plan. Instead, they serve as guidance based on the available information at the time. The Federal Reserve will release updated economic projections after its next meeting on June 14.

Social Plugin