Introduction:

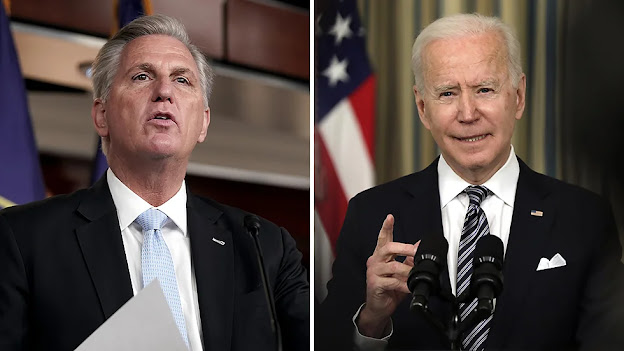

The United States is currently facing the critical challenge of averting a catastrophic debt default. Negotiations between House Speaker Kevin McCarthy and President Joe Biden's team are underway, aiming to reach an agreement before the looming June 5 deadline. While some progress has been made, there are still unresolved issues and differing demands between Republicans and Democrats. This blog post explores the ongoing negotiations, the potential consequences of a default, and the obstacles that need to be overcome for a successful resolution.

1. The Urgency of Reaching an Agreement:

Both McCarthy and Biden's teams acknowledge the gravity of the situation and the need to avoid a default. Treasury Secretary Janet Yellen has warned that a default could occur on June 5, which would have severe repercussions for the economy, including a possible recession, job losses, and increased consumer borrowing costs.

2. Negotiations and Remaining Challenges:

Negotiators have been working tirelessly to bridge the gaps between the two parties. McCarthy has indicated that he has had to concede to some Democratic demands, but he remains optimistic about meeting the June 5 deadline. However, not all issues have been resolved, and there are still some contentious points of disagreement. Republican Patrick McHenry, one of McCarthy's negotiators, acknowledges the challenges ahead and mentions that there are still "thorny issues" between House Republicans and the White House.

3. The Core GOP Demand: Curbing Runaway Spending:

A key demand from Republicans is to address the issue of runaway spending in exchange for raising the country's borrowing limit. McCarthy emphasizes that the emerging agreement focuses on cutting excessive spending, which aligns with the GOP's core principle. While not everyone may be satisfied with the final agreement, McCarthy believes that it is essential to strike the right balance.

4. Consequences of a Default:

Economists warn that a US debt default could have far-reaching negative consequences. The economy could plunge into a recession, leading to widespread job losses and increased borrowing costs for consumers. These potential repercussions would also spill over into the upcoming election year, making the situation even more critical.

5. Timing and Procedural Hurdles:

Time is of the essence, and negotiators are aware that they must reach an agreement promptly. McCarthy has pledged to adhere to a 72-hour rule, allowing lawmakers to review the text before voting. However, procedural hurdles in the Senate, combined with the rule, pose a risk of pushing Congress right up to the June 5 deadline.

6. Sticking Points and Trend of Lower Federal Spending:

Work requirements for anti-poverty programs and spending caps are among the remaining sticking points in the negotiations. Republicans have been pushing for work requirements, while Democrats have voiced opposition. Additionally, any agreement must demonstrate a trend of lower federal spending over multiple years, according to McHenry.

7. Environmental and Energy Regulations:

In the potential agreement, changes to permitting regulations for energy and other projects are being considered. It is suggested that the deal could ease environmental reviews for fossil fuel projects, a significant objective for the GOP, while simultaneously supporting a bill to enhance electric-transmission capacity, a priority for Democrats.

Conclusion:

The negotiations to avert a catastrophic US debt default are at a critical stage, with the June 5 deadline fast approaching. While progress has been made, there are still significant challenges to overcome. The consequences of a default would have severe implications for the US economy, making it crucial for negotiators to find common ground. As lawmakers work towards a resolution, it is essential to strike a balance between addressing runaway spending and maintaining economic stability. The coming days will determine whether an agreement can be reached to avoid the potential havoc a default could wreak on the nation's economy.

Social Plugin